If these are questions you’ve asked before, this blog post is for you. We’ll outline key market insights from the DACH hotel market using hotel pipeline data from our most recent quarterly report.

THP publishes these reports every quarter – and they’ve become a much-anticipated date in the calendars of hotel industry suppliers worldwide.

Read on to learn more about the DACH hotel market!

Germany remains the main driver of growth for DACH

Comprised of Europe’s three German-speaking countries – Germany (D), Austria (A), and Switzerland (CH) – the DACH region is often at the forefront of global hotel performance and trends, given its role in the wider European hotel market.

However, within DACH, Germany is responsible for the lion’s share of growth for 2024.

Almost 80% of hotels in the pipeline are located in Germany, with the country holding 632 of the 797 upcoming hotel projects in the DACH region.

This year’s figures fit the overarching trend in DACH from the past few years, which has seen most of the DACH hotel construction pipeline concentrated in Germany.

Compared to the 2023 levels, where Germany’s share of the DACH pipeline was 78.3%, the outlook has remained stable.

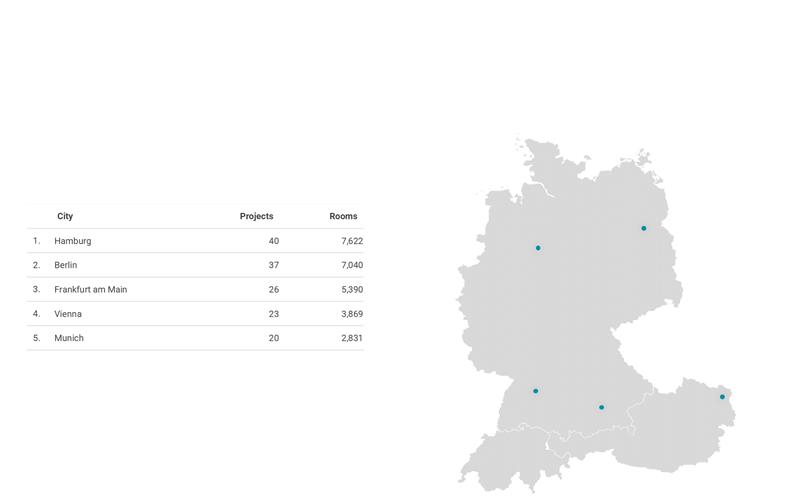

Hamburg takes centre stage in DACH

When it comes to the cities with the most hotel construction growth in DACH, you might be surprised to learn many aren’t capital cities.

Only three cities in the report’s top ten are capitals. But neither of these took out the number one position!

Hamburg, Germany’s second-largest city, edged out Berlin for the top spot in this quarter’s pipeline report.

The port city was also the strongest performer in 2023, indicating Hamburg has long-term potential for suppliers and investors.

First Class and Luxury projects grow in popularity

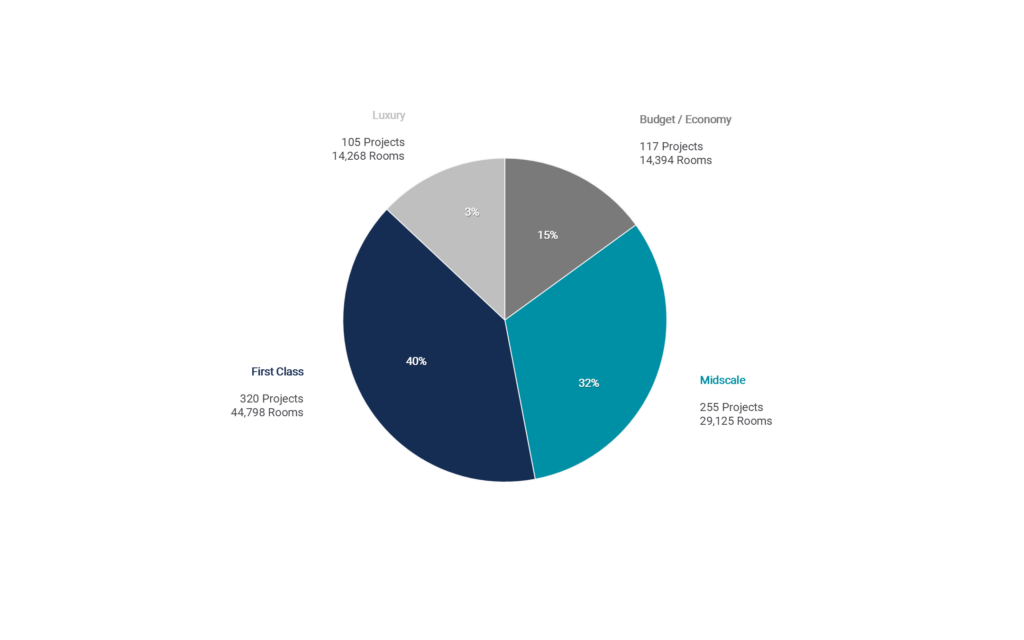

First Class and Luxury properties were the most popular types of hotel segment in THP’s most recent DACH hotel industry report.

In the First Class hotel category, which covers 5 star hotels, there are currently 320 projects spanning 44,478 rooms in the pipeline for the DACH region.

In the Luxury category, which covers 4 star hotels, there are 105 projects and 14,268 rooms in the pipeline.

These numbers are consistent with last year’s pipeline report, which also saw the First Class and Luxury segments booming in comparison to different hotel categories, including their economy and midscale counterparts.

For suppliers, there are many benefits to working with First Class and Luxury projects.

4 and 5 star hotels often require consistent, large-volume orders from suppliers and typically result in higher returns for businesses working in the sector thanks to the higher profit margin.

However, the midscale segment is not to be underestimated in the DACH region. In 2024 alone, midscale accounted for 32% of the hotel projects in Germany, Austria and Switzerland.

In 2023, THP’s pipeline report analysis revealed that DACH had over 300 hotel projects in the midscale pipeline. The consistency and strength of the number of hotel pipelines over the last two years (only -3% YoY from 2023 to 2024) should buoy suppliers looking to target midscale hotels.

Hotel Segment Categories

DACH-based companies invest in the region

Of the top five hotel groups in the 2024 pipeline report, two were German-based, while several were European.

This highlights the significant investment from DACH-based companies into their local pipelines and reflects their commitment to regional growth and development.

Deutsche Hospitality, which recently rebranded to H World International, has 18 hotel projects in the DACH pipeline this year.

Hamburg-based hospitality company Novum also has made significant moves into the DACH region, with 16 projects totalling 2,925 rooms in the pipeline for 2024.

Want to know more?

The complimentary insights on this page are just a sample of the industry-leading data analysis in our pipeline reports, which draw directly from hotel data within THP’s database.

Our pipeline reports provide clients with a clear and comprehensive overview of the hotel industry pipeline, both globally and within each of the world’s markets.

As the global hospitality industry’s most trusted data solutions provider, we’re proud that our advanced SaaS database consistently helps businesses find the information and contacts they need to get ahead in a competitive market.

If your business is looking to gain a better understanding of the fast-paced hotel market, the pipeline reports are a perfect place to start.